Streamline due diligence and uncover sales opportunities with our UCC Lien Data

Springstreet's Data

Access our enhanced database of the latest lending & borrowing activity across the United States. Identify borrowers, lenders, and industry trends through our data set.

The Financing Intelligence Platform

We analyze and enhance public commercial records to provide teams with actionable market intelligence. Our platform gives professionals the clarity to verify lien positions, uncover new business opportunities, and make informed commercial strategy decisions.

Lender Activity

Identify Lenders, their historical & latest lending activity, and overall trends. Analyze competitors and discover new lending opportunities.

Borrower Activity

Conduct better due diligence on businesses and verify their latest financing activity and commercial relationships.

Geographic Data

Access local, state, and regional activity throughout the US by analyzing the latest UCC filings. Gain insight into macroeconomic trends.

Detailed Financing History

Dive deep into a UCC's history. Discover important amendments, reassignments, terminations, and expirations.

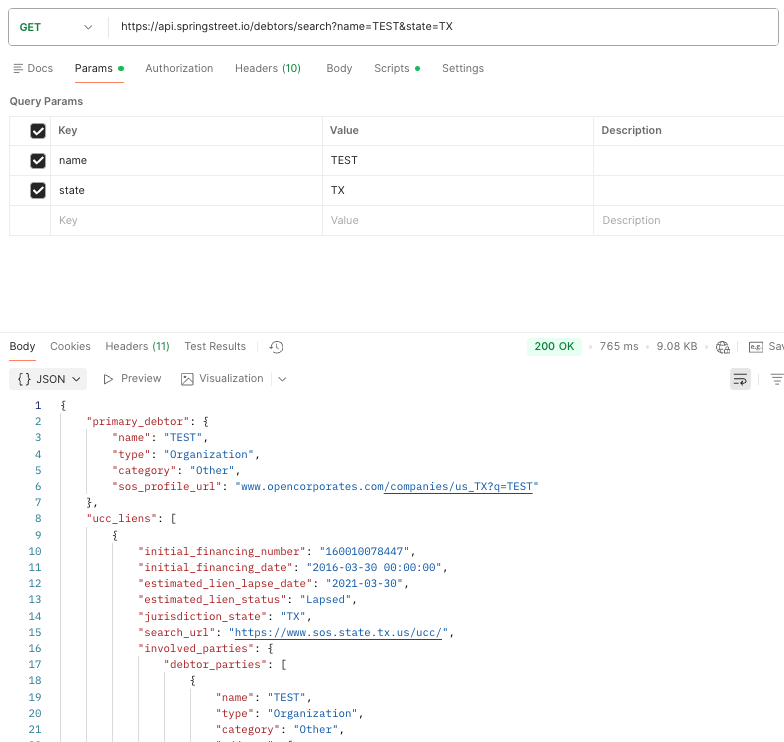

Powerful Search

Springstreet's powerful search platform allows users to apply advance filters and uncover critical UCC information.

Actionable Analytics

Springstreet's analytics summarize valuable UCC information. Quickly identify important dates, events, and stakeholders.

Robust Monitoring

Keep up to date on the latest UCC activity within your portfolio. Proactively monitor for UCC changes and address potential issues that may jeopardize your assets.

Customer Service

All users of Springstreet receive full access to our support team to address any questions or concerns you may have. We will always go the extra mile for your business.

Access over 1 Billion UCC data points

Instant Access to Critical Data

We built Springstreet to provide transparency into critical UCC Filing data and help lenders & borrowers make better decisions with an easy-to-use API.

NATIONWIDE COVERAGE

STANDARDIZED JSON

MODERN INFRASTRUCTURE

UP-TO-DATE API DOCUMENTATION

Simple, Transparent, Flexible Pricing

Online Search

$0/mo

Seriously Free.

Search debtors and have access to Springstreet's powerful browsing functions

-

Access to all available States

-

Debtor Search & Browsing

-

Detailed UCC Filing Information

-

Easy Search Results

-

Online Support

Data Subscription

$500/mo

Recurring data exports and reporting.

Search and Monitor for the latest borrowing and lending activity each month.

-

Recurring Exports of Data

-

Custom Filters

-

Advanced Query Support

-

Portfolio Monitoring

-

Online & After-hours Support

API Subscription

Custom

Made for scale.

Access Springstreet's priorietary database for large scale data operations.

-

Direct Access to Springstreet Database

-

Latest Springstreet data enhancements

-

Modern Data Infrastructure

-

Scalable & Secure Data Transfer

-

Priority Support

How can Springstreet help

How does Springstreet improve Due Diligence?

Springstreet's UCC Data API empowers commercial teams to instantly verify collateral availability and identify existing secured interests. By automating public record searches and providing current filing status, this API helps organizations uncover hidden liens, clarify priority positions, and structure deals with greater confidence.

Can Springstreet accelerate sales cycles?

Springstreet's UCC data empowers sales teams to identify high-activity businesses and monitor market trends. Track competitor filings, pinpoint expanding companies, and reach out with timed solutions based on public filing events. Transform raw public records into a precise market intelligence tool.

Is it possible to identify industry & geographic trends?

Springstreet's UCC data provides invaluable insights into recent lending activity. By analyzing this data, lenders and investors can identify emerging industry trends, assess regional market risks, and gain a competitive edge to better inform investment strategies and maximize returns.

Can I analyze or monitor UCC activity?

Springstreet's UCC data API can help users identify key filing changes happening within a portfolio. Quickly analyze lending activity and stay up-to-date on new secured filings and collateral updates.

Do you offer flat-rate pricing

Springstreet offers flat-rate pricing based on the data coverage you need, making it easy to budget and scale your UCC data access. For more information or to get a custom quote, please email us at hello@springstreet.io.

Access Extensive Lending Data

Monitor secured filing activity across the United States. Generate deep insights and uncover valuable trends to help improve and protect your investments.